Question: I am expecting to submit a request for an installment loan in the near future, but my credit score is only 440. Am I going to be able to get a installment loan, or is it going to be rejected wherever I try?

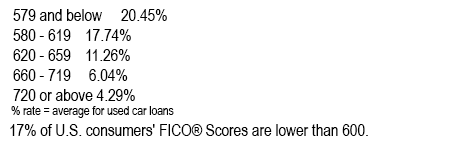

Answer: With a credit score currently at 440 its quite possible to apply successfully for an installment loan, although interest levels loans such as this can be a touch steeper than average. Look at this loan data from the guys at Experian:

Indeed, Experian also highlighted that installment loan customers having scores under 670 characterized 33% of all 2022 installment loan applicants!

With a credit score close to 440, you can expect to have a decent chance being approved for that loan if you put in a request for installment loans online. Doing this means that it’s possible to explore offers from a large array of loan companies. If you’re not sure how to go about this, have a look at our handy list of suggestions.

The exact same answer holds good for installment loans for borrowers with a credit score of 441, 442, 443, 444, 445, 446, 447, 448, and 449.

Despite the fact that you are able to successfully submit a request for an installment loan or personal loan with a low credit ranking, the problem is that you will be charged an elevated interest rate. You might also have a shot at increasing your own FICO score.

Improve your interest rate and credit score

Allow me to share a few strategies for possibly raising your credit score when you need to apply for an installment loan:|Will a 440 Credit Score Get Me an Installment Loan with a low interest?

- Request your free credit reports, check them for errors, and contest any you find.

- Join Experian Boost to have your utilities and telephone bill payments counted toward your credit scores.

- Credit cards, lower the amount of your credit you are using below thirty percent.

- Many loan companies are prepared to pardon one-time mistakes and wipe them from your record. Find out if this is applicable in your situation.

- Get current on as many bills and debts as possible.

What is an Installment Loan?

Installment loans are a credit choice where borrowers can potentially obtain a given chunk of cash and return it in pre-agreed repayment schedules. Some of the traditional installment loans are consumer loans, mortgages, and automobile loans.

An installment loan is actually distinctive compared to any credit strategy, such as, a credit card.

Leave a Reply