Question: I am going to apply for an installment loan in the next few days, though my credit score is just 616. Will that be sufficient to get a installment loan, or will my application be rejected everywhere I go?

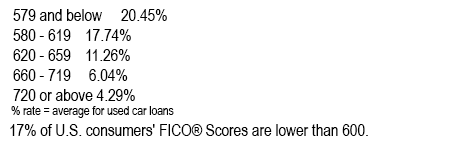

Answer: With a credit score currently at 616 it’s quite possible to apply successfully for an installment loan, but interest rates for such loans are often a little steeper than average. Look carefully at this information which comes straight from the credit ranking company Experian:

In fact, Experian stated that installment loan customers having credit scores under 670 represented thirty three of all installment loan customers during 2022!

If your credit score is around 616, you’re going to a fair prospect of qualifying for finance if you apply for installment loans online. Using this procedure means it’s straightforward to explore interest rates from a broader assortment of finance companies. If you’re not sure how to start, have a read of our extensive companies list.

Exactly the same solution applies for installment loans for borrowers having credit scores of 617, 618, 619, 620, 621, 622, 623, 624, and 625.

Though you’ll be able to put in a successful application for a personal loan or an installment loan with a very bad credit standing, the drawback is that you will end up paying an elevated interest rate. You also can try to boost your current FICO (Fair Isaac Corporation) score.

Improve your interest rate and credit rating

Let us discuss a few strategies for perhaps raising your credit score before applying for a personal loan / installment loan:|Will a 616 Credit Score Get Me an Installment Loan with a low interest?

- Request free credit reports, check them out for flaws, and contest any you come across.

- Credit cards, decrease your credit liability to below thirty percent.

- Settle as many debts and bills as possible.

- A number of lenders are willing to forgive one-time slip-ups and wipe them from your credit history. Establish if this can be applied in your situation.

- Sign up for Experian Boost to get your utilities and telephone bill payments counted towards your credit rating.

Installment Loans explained

Installment loans are a credit facility where borrowers are able to receive a given chunk of cash and repay it in pre-decided installments. Among many conventional installment loans are personal loans, mortgage bank loans, and car loans.

An installment loan is rather distinctive in contrast to any credit approach, such as, a credit card.

Leave a Reply