Question: I’m intending to try for an installment loan in the next few days, though I’ve got a credit score of just 720. Will I be able to obtain a installment loan, or will I be rejected everywhere I try?

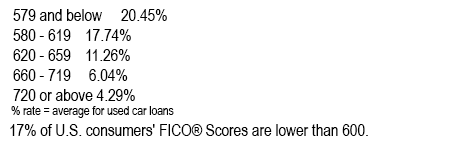

Answer: It is definitely possible to apply successfully for an installment loan with a strong 720 credit score. Contemplate this loan data which comes directly from Experian:

Believe it or not, Experian highlighted that installment loan customers with credit scores below 670 represented 33% of all installment loan borrowers (2022).

If your credit score is near to 720, you’ll have the best odds of being approved for loan finance if you apply for installment loans online. Using this procedure makes it very easy to look for all the proposals from a larger assortment of loan companies, and additionally you will be using the services of companies who are far more flexible with respect to authorizing borrowers with high credit scores. If you are not sure how to begin, examine our useful recommendations list.

Lenders you could try out: Sofi, Upstart & Best Egg.The very same strategy works perfectly for installment loans for those having credit score 721, 722, 723, 724, 725, 726, 727, 728, and 729.

Consequently you’re able to make a successful request for an installment loan or personal loan with a very high credit standing, the positive aspect is that you will incur a reduced interest rate. You also can have a shot at maximizing your own FICO (Fair Isaac Corporation) score even if your chances are really good for low interest rates.

How you can improve your interest rate & credit rating

Listed here are some ideas for perhaps elevating your credit score before applying for a personal loan / installment loan:

- A number of loan companies sometimes excuse one-off failures and get them erased from your credit history. Check into this if it can be applied in your case.

- Obtain your free credit reports, check them out for mistakes, and contest any you find.

- Get registered on Experian Boost so your telephone and utility payments counted toward your credit score.

- Get up-to-date on as many debts and bills as possible.

- Credit cards, lower your credit amount to below 30%.

What is an Installment Loan?

Installment loans are a credit facility where customers may borrow a particular chunk of money and reimburse it in pre-agreed repayments. Among many common installment loans are consumer loans, mortgage bank loans, and auto loans.

It encompasses a pre-arranged repayment period coupled by a decided-upon loan figure.

Leave a Reply